The history of the Stage 3 tax cuts

The then government originally announced their Personal Income Tax Plan in the May 2018 Budget. The plan was to be implemented in three stages over seven years and the ‘Stage 3 tax cuts’ refers to the final stage of this Personal Income Tax Plan.

The Stage 1 tax cuts introduced a temporary low to middle income tax offset (LMITO) which only applied for the 2018-19 to 2021-22 income years.

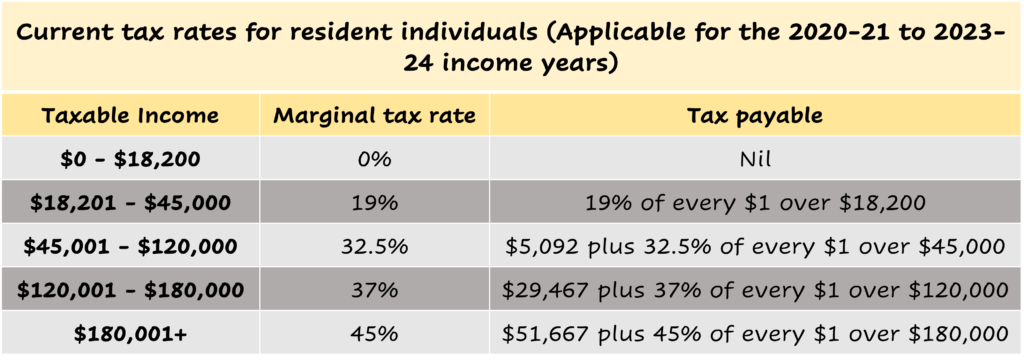

The Stage 2 tax cuts increased the upper taxable income threshold for the 32.5% marginal rate bracket from the 2018-19 income year and (as originally announced) also increased the low-income tax offset and the upper taxable income thresholds for the 19% and 32.5% marginal rate brackets from the 2022-23 income year.

In the October 2020 budget (the COVID-19 economic recovery plan) it was announced that the Stage 2 tax cuts that were to take effect from the 2022-23 income year would be brought forward to take effect from the 2020-2021 income year.

Stage 3 and the proposed changes

The Stage 3 tax cutsas originally announced would again increase the upper taxable income threshold for the 32.5% marginal rate bracket, completely removing the 37% marginal rate bracket from 2024-25 income year.

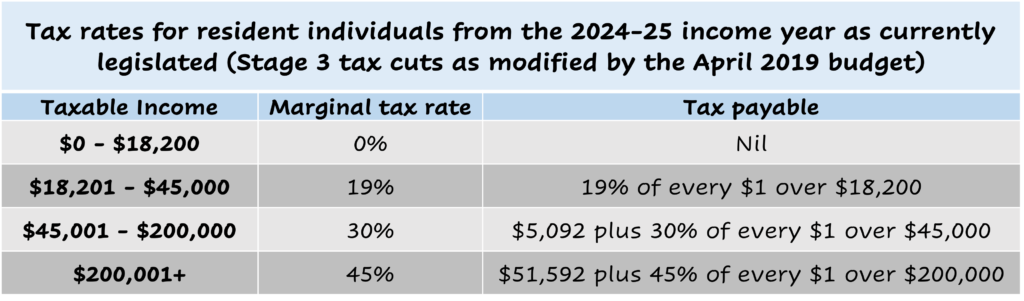

In the April 2019 budget it was announced that the 32.5% marginal rate would be replaced with a 30% marginal rate from the 2024-25 income year.

The Stage 3 tax cuts as originally announced (modified by the above change announced in the April 2019 budget) have already been made law so, in the absence of future law change to give effect to the recent announcement, take effect from 1 July 2024.

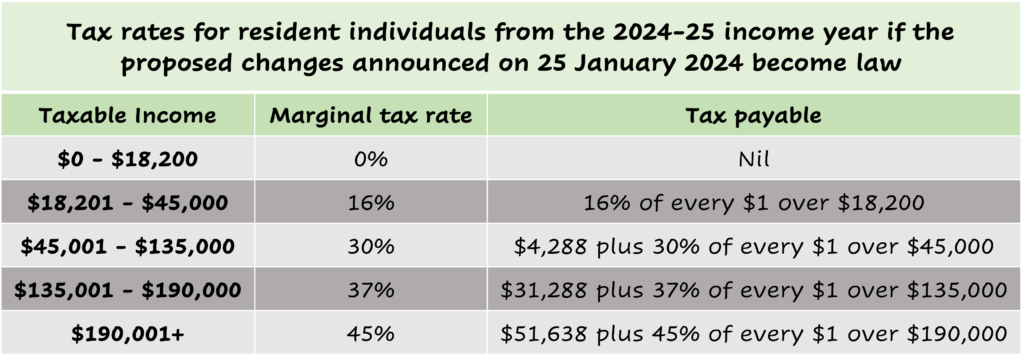

The proposed changes to resident individual income tax rates announced by the current government on 25 January 2024 (if and when they are made law) will effectively modify the income rates which would have otherwise taken effect from 1 July 2024 by reducing the lowest marginal rate from 19% to 16%, reinstating the 37% marginal rate bracket (with a $135,000 lower taxable income threshold) and reducing the lower taxable income threshold which would otherwise have applied for the 45% marginal rate bracket from $200,000 to $190,000

Individual tax rates from 1 July 2024: Previous Stage 3 tax cuts vs proposed changes vs current rates

#tax #taxrates #incometax #stage3taxcuts #taxmam

The tax rates included in the above commentary and the figures in the tables do not consider / include the Medicare levy